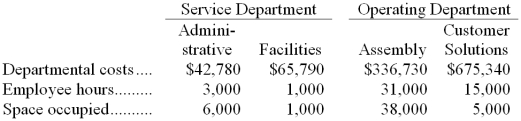

Franca Corporation has two service departments, Administrative and Facilities, and two operating departments, Assembly and Customer Feedbacks.  The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.

The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.

-The total amount of Administrative Department cost allocated to the Assembly Department is closest to:

Definitions:

Computers

Electronic devices designed to process, store, and communicate information, playing a crucial role in both personal and professional settings.

Tax Book Value

Refers to the value of an asset or liability for tax purposes, distinguished from the actual market value or the value recorded on financial statements.

Depreciable Asset

An asset whose cost is gradually deducted over its useful life due to wear and tear, decay, or obsolescence.

Acquisition Cost

The total cost involved in acquiring an asset, including the purchase price and other expenses such as legal fees, installation charges, and transportation.

Q1: Holding all other things constant, if the

Q2: For Year 2, sales adjusted to a

Q9: Using the least-squares regression method, the estimate

Q16: A reference document is designed so the

Q18: Becky's employer offers fringe benefits that cost

Q24: What would be the total external failure

Q28: APS Systems would like to convert to

Q30: The main problem with the parallel conversion

Q51: A partial listing of costs incurred at

Q70: One of the earliest models for managing