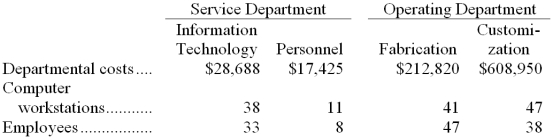

Weisenborn Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Information Technology and Personnel, and two operating departments, Fabrication and Customization.  Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

-The total Fabrication Department cost after service department allocations is closest to:

Definitions:

Overapplied Manufacturing Overhead

A scenario in which the overhead costs assigned to manufacturing exceed the actual overhead expenses incurred.

Cost of Goods Sold

An expense measured and recorded on the income statement, representing the total cost of goods that were sold during a specified period.

Manufacturing Overhead Account

An account that tracks indirect production costs such as factory utilities, maintenance, and rent.

Job Costing

A method of costing that assigns expenses to specific jobs or projects.

Q10: Vanstraten Corporation has provided the following data

Q11: When computing the net present value of

Q12: The programming process of a new systems

Q23: Up to how much should the company

Q25: The total amount of Administrative Department cost

Q35: Winkle Company uses the FIFO method in

Q38: In general, for any change that has

Q51: What was Mzimba's variable overhead rate variance?<br>A)

Q75: The general structure used in most on-line

Q95: Manufacturing overhead for the year was:<br>A) $84,000<br>B)