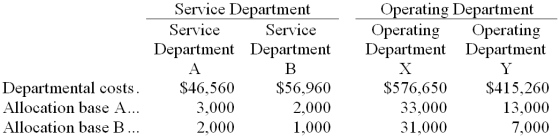

Costillo Corporation has two service departments, Service Department A and Service Department B, and two operating departments, Operating Department X and Operating Department Y.

The company uses the step-down method to allocate service department costs to operating departments. Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base

B.

Required:

Allocate the service department costs to the operating departments using the step-down method.

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was put into service.

Acquisition Cost

The total cost incurred to acquire an asset, including the purchase price and all related expenses.

Indirect Method

A way of reporting net cash flows from operating activities in a cash flow statement by starting with net income and adjusting it for changes in balance sheet items.

Operating Activities

Business activities related to the core functions of a company including production, sales, and delivery of the company’s products and services.

Q2: According to the activity-based costing system, what

Q6: How much fixed manufacturing overhead was applied

Q6: Last year Madson Company reported a cost

Q14: Drake Company purchased materials on account. The

Q22: If the denominator level of activity is

Q27: Project team review is usually conducted _.<br>A)

Q31: Lafaso Corporation has provided the following data

Q34: The guideline for crafting documentation that when

Q55: Management of Delaune Corporation is considering a

Q81: The cost of goods sold for December