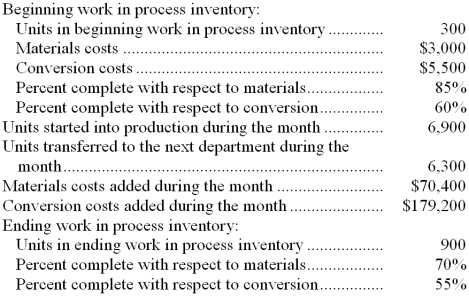

Noda Corporation uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month are listed below:  Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The cost per equivalent unit for conversion costs for the first department for the month is closest to:

Definitions:

Excise Tax

A tax levied on specific goods, such as alcohol and tobacco, usually to discourage consumption or generate revenue.

Buyers

Entities or groups that buy products or services for private consumption, for selling them again, or for creating other goods.

Tax Burden

The measure of taxation imposed on individuals, businesses, or goods, often expressed as a percentage of income or sales price.

Excise Tax

A tax levied on specific goods, services, or transactions, often to discourage consumption or generate revenue for specific purposes.

Q8: What would be the total appraisal cost

Q13: In November, one of the processing departments

Q19: Enhancements suggested by users to make the

Q19: What was the fixed manufacturing overhead volume

Q21: Quality of conformance refers to the extent

Q22: The function that provides the processing required

Q23: For August, the variable overhead efficiency variance

Q37: Cafeteria costs are allocated on the basis

Q44: If service department costs are allocated using

Q68: Beta testing is part of performance testing.