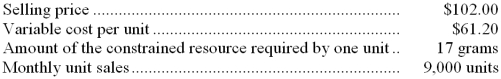

Alberding Corporation would like to determine the relative profitability of the company's products for purposes of making volume trade-off decisions. For illustration, the company has provided the following data for product S06K:

What is the profitability index for product S06K?

Definitions:

Interperiod Tax Allocation

A method used in accounting to allocate income taxes over different periods to match taxes with the revenues they affect.

Future Enacted Tax Rates

Tax rates that have been passed into law but will go into effect at a future date, relevant for financial planning and reporting.

Asset/Liability Method

A method used in accounting to adjust the books for tax purposes, balancing the future tax benefits of assets against the future tax obligations of liabilities.

Accelerated Cost Recovery

A method of depreciation used for tax purposes that allows for higher deductions in the early years of an asset's life.

Q3: Senior management has established the priority for

Q7: When a dispute arises over a transfer

Q17: Madero Corporation's manufacturing overhead includes $6.20 per

Q30: What are the equivalent units for materials

Q35: Gamification deals with applying gaming mechanics to

Q35: Hopp Corporation uses the direct method to

Q42: Attleson Corporation has designed a new product,

Q44: The following direct labor standards have been

Q75: When all of the modules of a

Q79: When an organization chooses to convert the