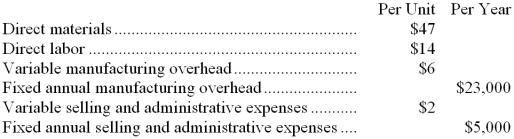

The management of Matsuura Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 1,000 units of the new product annually. The new product would require an investment of $254,000 and has a required return on investment of 10%.

Management plans to produce and sell 1,000 units of the new product annually. The new product would require an investment of $254,000 and has a required return on investment of 10%.

-To the nearest whole percent, the markup percentage on absorption cost is:

Definitions:

Weighted Average

A calculation that takes into account the varying degrees of importance of the numbers in a data set, assigning weights to each number.

Shares Outstanding

The total number of shares of a corporation that are currently owned by all its shareholders, including share blocks held by institutional investors and restricted shares owned by the company’s officers and insiders.

Mill Rates

The amount of tax payable per dollar of the assessed value of a property, used in calculating local property taxes.

Assessed Value

The dollar value assigned to a property for purposes of taxation by the government.

Q8: Kirsch Corporation's standard wage rate is $13.40

Q18: When the actual direct labor-hours are less

Q24: The grammar order of the navigation controls

Q29: In both the direct and step-down methods

Q31: Reciprocal service department costs are:<br>A) allocated to

Q49: The fixed manufacturing overhead budget variance is

Q56: System tests are conducted by the systems

Q56: What are the equivalent units for materials

Q57: Because of potential problems, developers must be

Q58: The Relational DBMS only supports simple data