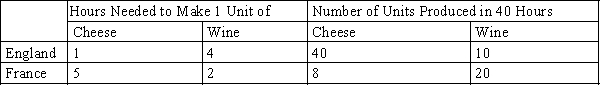

Table 3-3

Production Opportunities

-Refer to Table 3-3. Which of the following combinations of cheese and wine could England not produce in 40 hours?

Definitions:

Forward Contract

A bespoke arrangement between two parties for acquiring or disposing of an asset at a designated price on an upcoming date.

Hedge

An investment made to reduce the risk of adverse price movements in an asset.

Speculative Forward Contract

A financial derivative used to speculate on the future price of an asset, involving an agreement to buy or sell the asset at a future date for a price determined today.

Fair Value Hedge

A risk management technique that uses financial instruments to mitigate the risk associated with changes in the fair value of an asset or liability.

Q171: The most obvious benefit of specialization and

Q207: Refer to Figure 3-15. Perry has a

Q215: Economic models are most often composed of

Q219: Refer to Figure 2-14. The bowed outward

Q343: It is difficult for economists to make

Q393: Refer to Table 3-25. The opportunity cost

Q417: Refer to Figure 2-9, Panel a). The

Q495: The y-coordinate is the<br>A) first number of

Q599: In principle, we can<br>A) ignore positive statements

Q604: Suppose a war in the Middle East