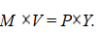

Define each of the symbols and explain the meaning of

Definitions:

Tax

A mandatory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to fund various public expenditures.

Consumer Surplus

The difference between the total amount that consumers are willing and able to pay for a good or service versus what they actually pay.

Deadweight Loss

An economic inefficiency arising when the balance for a product or service fails to be attained or is unattainable.

Tax

A necessary financial assessment or some other type of taxation levied upon a taxpayer by a government entity, intended to fund the expenditure of government and various allotments for public services.

Q3: If the economy unexpectedly went from inflation

Q40: Which two of the Ten Principles of

Q57: If Israel's domestic investment exceeds its national

Q87: U.S. tax laws allow taxpayers, in computing

Q244: Relative-price variability<br>A) rises with inflation, leading to

Q271: Over the past six decades, the U.S.

Q281: You observe people going to the bank

Q298: Firms in Saudi Arabia sell oil to

Q307: There was hyperinflation during the<br>A) period 1880-1896

Q394: A good in the U.S. costs $20.