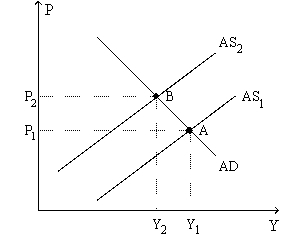

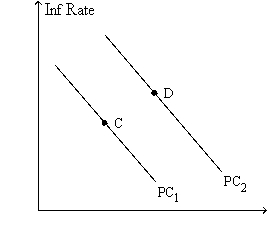

Figure 35-9. The left-hand graph shows a short-run aggregate-supply SRAS) curve and two aggregate-demand AD) curves. On the right-hand diagram, "Inf Rate" means "Inflation Rate."

-Refer to Figure 35-9. Faced with the shift of the Phillips curve from PC1 to PC2, policymakers will

Definitions:

Company Tax Rate

The rate at which a company’s taxable income is taxed by the government, which varies by country and sometimes also by the type and size of the company.

Inventories

Goods owned with the intention to sell them through standard business activities, in the stage of being made for sale, or as parts or materials meant for consumption in production activities or while offering services.

Consolidation Worksheet

A tool used in the preparation of consolidated financial statements to combine the financial information of a parent company with its subsidiaries.

Subsidiary Entity

An entity that is controlled by another entity, the control often being evidenced through ownership of more than half of the voting rights or through other means of control.

Q75: If a central bank were required to

Q144: In 2009 President Obama and Congress increased

Q235: Which of the following might explain a

Q254: Which of the following is not correct?<br>A)

Q277: When aggregate demand shifts left along the

Q284: Part of the argument against deficits is

Q322: A. W. Phillips' findings were based on

Q345: In fiscal year 1997, the U.S. government

Q463: Refer to The Economy in 2008. In

Q511: Suppose the Fed increased the growth rate