The following information relates to questions 20 to 22

Aussie Ltd has a controlling interest in Pommie Plc. On 1 June 20X5 Pommie sold inventory to Aussie for 10 000 pounds. The inventory was originally acquired by Pommie on 18 May 20X5 for 7000 pounds. The entire amount of inventory was held by Aussie at 30 June 20X5. The Australian tax rate is 30% and the British tax rate is 35%.

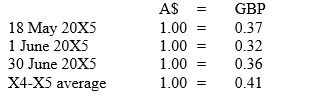

Exchange rates are as follows:

-The debit to the deferred tax asset account in relation to the elimination of the intragroup sale (to the nearest whole dollar) is:

Definitions:

Autonomic Nervous System (ANS)

The segment of the nervous system responsible for regulating automatic body functions such as heartbeat, digestive processes, and breathing rate.

Muscle Tone

Relatively constant tension produced by a muscle for long periods as a result of asynchronous contraction of motor units.

Heart Rate

The number of heartbeats per unit of time, typically expressed as beats per minute (bpm), indicating cardiovascular activity.

Cholinergic Neurons

Neurons that release acetylcholine, a neurotransmitter involved in many functions including muscle movement and memory.

Q3: When translating foreign currency denominated financial statements

Q3: Nelson Ltd manufactures specialised machinery for both

Q10: Operating activities on a Statement of Cash

Q11: Under IAS 17 Leases, lessors are required

Q13: When translating into the functional currency foreign

Q16: When an asset is measured using the

Q22: Company A Limited and Company B Limited

Q23: The Noor group prepared the following acquisition

Q28: The following items are NOT deemed to

Q34: Which region led the nation in manufacturing?<br>A)