The following information relates to questions 20 to 22

Aussie Ltd has a controlling interest in Pommie Plc. On 1 June 20X5 Pommie sold inventory to Aussie for 10 000 pounds. The inventory was originally acquired by Pommie on 18 May 20X5 for 7000 pounds. The entire amount of inventory was held by Aussie at 30 June 20X5. The Australian tax rate is 30% and the British tax rate is 35%.

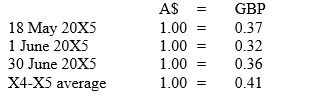

Exchange rates are as follows:

-The credit to cost of goods sold to eliminate the intragroup sale (to the nearest whole dollar) is:

Definitions:

Accounts Receivable

Money owed to a business by its customers for goods or services delivered but not yet paid for.

Accounts Payable

Liabilities of a business that represent amounts owed to creditors for goods and services received but not yet paid for.

Sunk Costs

Expenses that have already been incurred and cannot be recovered, which should not affect future business decisions.

Capital Budgeting

The process by which a business evaluates and selects long-term investments that are expected to yield returns over a period of time longer than one year.

Q10: Under the cost model, after initial recognition

Q11: Under the revaluation method of measuring an

Q18: The following item is classified as a

Q23: When preparing and presenting a consolidated statement

Q25: IFRS 10 Consolidated Financial Statements, requires that

Q25: When deciding whether or not control exists

Q28: In 1860, the largest number of white

Q58: February 1848 agreement that ended the Mexican-American

Q67: A law included in the Compromise of

Q71: Term for the bloody struggle between proslavery