The following information relates to questions 20 to 22

Aussie Ltd has a controlling interest in Pommie Plc. On 1 June 20X5 Pommie sold inventory to Aussie for 10 000 pounds. The inventory was originally acquired by Pommie on 18 May 20X5 for 7000 pounds. The entire amount of inventory was held by Aussie at 30 June 20X5. The Australian tax rate is 30% and the British tax rate is 35%.

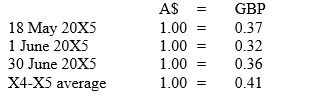

Exchange rates are as follows:

-The debit to the deferred tax asset account in relation to the elimination of the intragroup sale (to the nearest whole dollar) is:

Definitions:

Monopoly Markets

Markets in which there is only one supplier of a unique product or service, giving the supplier significant control over price and market conditions.

Perfectly Competitive Markets

Markets where there are many buyers and sellers, all products are identical, and no single buyer or seller can influence the market price.

Marginal Cost

The augmentation in complete cost associated with the production of an additional unit of a product or service.

Government Intervention

Actions taken by a government to affect the economy, which can include regulations, subsidies, taxes, and the provision of public goods.

Q9: 1804-1806 exploration of the trans-Mississippi West for

Q12: When Andrew Jackson was a presidential candidate,

Q14: How did powerful whites defend slavery from

Q17: The following remuneration categories must be disclosed

Q21: Pirate Ltd employs 5 staff. Each staff

Q28: The nominal value of an accumulated benefit

Q37: Most upcountry yeomen focused on cultivating<br>A) cotton.<br>B)

Q63: Legal doctrine grounded in British common law

Q69: By 1820, divorce in the United States<br>A)

Q77: What did the Mexican-American War reveal about