The following information relates to questions 17 to 21

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

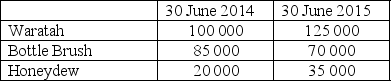

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Bottle Brush for the year ended 30 June 2014 is:

Definitions:

Specific Gravity

The ratio of dissolved substances in a solvent as compared with the ratio of dissolved substances in distilled water, most commonly comparing the ratio of dissolved substances in a urine specimen with distilled water.

Reagent Strips

Test strips used for urinalysis or other tests that change color in response to various conditions or the presence of specific substances.

Manufacturer's Instructions

Guidelines provided by the makers of a product on how to properly use, maintain, or install it to ensure safety and effectiveness.

Throat Swab

A method of collecting a sample from the throat using a sterile swab, commonly used to test for infections.

Q5: Who founded the "underground railroad" to help

Q9: Most large oil and gas companies use

Q12: Jon holds an investment in Voight Limited

Q15: Determining an entity's liability for long service

Q16: A Ltd holds a 60% interest in

Q20: IAS 19 adopts which method to determining

Q21: Goodwill arising in a business combination is

Q22: E&E assets are required to be tested

Q25: Which of the followings are the requirements

Q34: Which region led the nation in manufacturing?<br>A)