The following information relates to questions 17 to 21

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

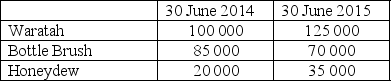

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Bottle Brush for the year ended 30 June 2015 is:

Definitions:

Interstate Commerce

Involves trade, traffic, or transportation of goods or services across state lines within the United States.

Protectionist State Restrictions

Regulations implemented by a state to protect its domestic industries from foreign competition, often through tariffs, quotas, and other trade barriers.

Taxing Power

Taxing Power is the governmental authority to impose taxes on individuals, entities, and transactions to raise revenue for public purposes.

Federal Government

The national government of a federal state, where powers are divided between a central authority and constituent political units (like states or provinces).

Q3: The indirect non-controlling interest, in a group

Q5: The main concerns about the current accounting

Q9: A key objective of providing financial reporting

Q9: For the purposes of calculating diluted earnings

Q9: Two entities are not regarded as related

Q18: A parent entity group sold a depreciable

Q24: In relation to 'retained earnings', IAS 1

Q28: If an operating segment does not meet

Q28: When women began to break out of

Q74: Which of the following restrictions was placed