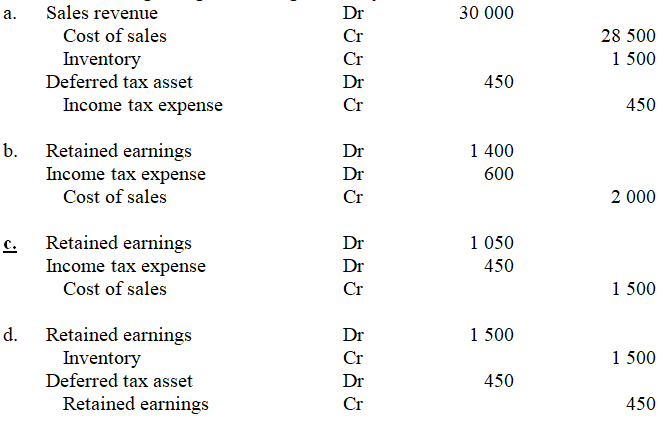

During the year ended 30 June 20X7 a subsidiary entity sold inventory to a parent entity for $30 000. The inventory had previously cost the subsidiary entity $24 000. By 30 June 20X7 the parent entity had sold 75% of the inventory to a party outside the group. The company tax rate is 30%. The adjustment entry in the consolidation worksheet at 30 June 20X8 is:

Definitions:

Problematic Emotional Extremes

Experiencing emotions that are excessively intense or out of proportion to the situation, which can interfere with daily functioning.

Breathless Euphoria

A state of intense happiness and exhilaration that may occur suddenly and intensely enough to overshadow normal breathing patterns.

Exaggerated Belief

An overstatement or inflation of the truth or reality of a situation, often leading to distorted thinking patterns.

Uncontrollable Losses

Events or situations that result in loss beyond an individual's control, often leading to feelings of helplessness or despair.

Q1: Why did the United States declare war

Q1: The NCI share of profit in the

Q12: When determining the fair value of biological

Q17: During the financial year Sugianto Limited had

Q20: Earthen constructions by ancient American peoples, especially

Q20: ABC Limited acquired an item of plant

Q22: What did state legislatures do when faced

Q25: The goodwill arising on Claudia's acquisition of

Q29: Stock take discrepancies between a count sheet

Q56: Why did so many migrants move to