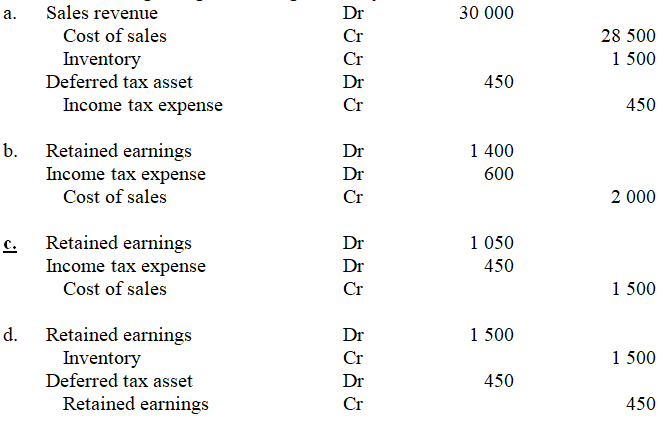

During the year ended 30 June 20X7 a subsidiary entity sold inventory to a parent entity for $30 000. The inventory had previously cost the subsidiary entity $24 000. By 30 June 20X7 the parent entity had sold 75% of the inventory to a party outside the group. The company tax rate is 30%. The adjustment entry in the consolidation worksheet at 30 June 20X8 is:

Definitions:

Independent Internal Verification

The process of having internal procedures reviewed by parties within the organization who are independent of the process being evaluated.

Discrepancies

Differences or inconsistencies found in records, reports, or documents, usually requiring investigation or correction.

Pre-Announced Basis

A strategy or condition disclosed in advance, usually to provide stakeholders with time to prepare or adjust.

Misappropriation Of Assets

The unauthorized use or theft of a company's assets for personal gain.

Q2: When Mexico refused the Polk administration's offer

Q15: Typically industries where operating cycles may exceed

Q17: Why did massive numbers of immigrants pour

Q26: IAS 2 Inventories requires that when inventories

Q27: At reporting date, the carrying amount of

Q30: Why did Archaic cultures in the Southwest

Q44: What did transcendentalists believe?<br>A) Women should get

Q47: Evaluate the following statement about ancient Americans:

Q67: How did the government intervene to assist

Q74: Which statement describes the economic status of