Use the following information to answer questions 14 and 15

An extract of a company's draft statement of financial position at 30 June 2012 discloses the following:

On 30 June 2013 the company assessed the fair value of the plant to be $350 000. At 30 June 2014, the carrying amount of the Plant was $250 000.

On 30 June 2013 the company assessed the fair value of the plant to be $350 000. At 30 June 2014, the carrying amount of the Plant was $250 000.

The tax rate is 30%. Depreciation rates are 10% p.a. (accounting) and 12.5% p.a. (tax) using the straight-line method.

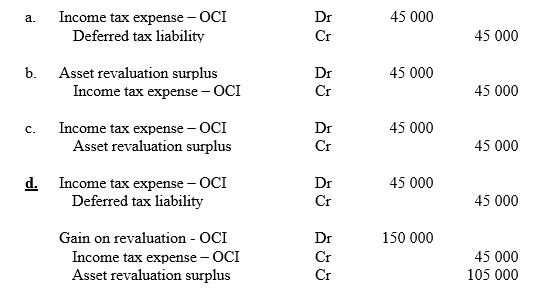

-The journal entries to adjust for the tax effect of the revaluation at 30 June 2013 is:

Definitions:

Birth

The process by which a baby is born, marking the end of pregnancy.

Low Birth Weight

A condition where a newborn weighs less than 2,500 grams (5 pounds, 8 ounces) at birth, often associated with preterm birth or poor fetal growth.

Oxygenation

The process of providing or adding oxygen to the body or a biological environment.

Neutral Thermal Environment

A condition in which the environment contributes to maintaining a body's core temperature without needing to increase metabolic heat production.

Q2: On 1 July 20X6, P Limited acquired

Q3: The Chartered Institute of Management Accountants (CIMA)

Q7: Examples of related party transactions that must

Q11: Which of these statements is the most

Q11: The INCI in B Ltd is the

Q14: Reload features are accounted for as follows:<br>A)

Q19: A Limited has a 60% ownership interest

Q21: Yandos Limited has made a loan of

Q23: Balchin Limited had the following deferred tax

Q28: Differences arise in relation to the treatment