Use the following information to answer questions 14 and 15

An extract of a company's draft statement of financial position at 30 June 2012 discloses the following:

On 30 June 2013 the company assessed the fair value of the plant to be $350 000. At 30 June 2014, the carrying amount of the Plant was $250 000.

On 30 June 2013 the company assessed the fair value of the plant to be $350 000. At 30 June 2014, the carrying amount of the Plant was $250 000.

The tax rate is 30%. Depreciation rates are 10% p.a. (accounting) and 12.5% p.a. (tax) using the straight-line method.

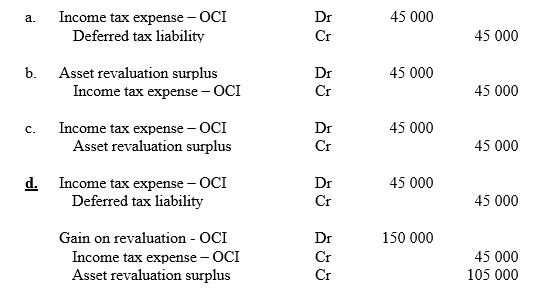

-The journal entries to adjust for the tax effect of the revaluation at 30 June 2013 is:

Definitions:

Party Organization

The structure, leadership, and operations of a political party, including its national, state, and local committees and executives.

New Deal Democratic Coalition

An alliance of voter groups and interests united behind the Democratic Party, primarily during the presidency of Franklin D. Roosevelt, supporting his New Deal policies to address the Great Depression.

1896 System

The U.S. political alignment and dynamics that emerged from the 1896 presidential election, influencing American politics for years.

Party Primary

An election in which members of a political party vote to choose their party's candidate for a forthcoming general election.

Q1: Which of the following assets is regarded

Q2: The uncertainty that exists in relation to

Q2: The Appendix to IAS 18 contains illustrative

Q3: When translating foreign currency denominated financial statements

Q6: Which of the following is NOT excluded

Q7: An error is an intentional misstatement in

Q7: Which of the following journal entries demonstrates

Q12: Which of the following methods is the

Q20: Which of the following are included in

Q22: Under IAS 21 The Effects of Changes