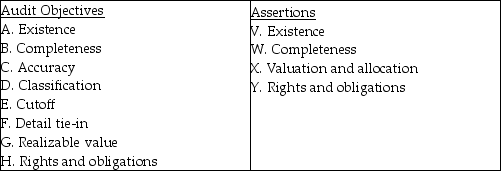

Below are five audit procedures, all of which are tests of balances associated with the audit of accounts receivable. Also below are the eight general balance-related audit objectives and the four management assertions. For each audit procedure, indicate (1) its audit objective, and (2) the management assertion being tested.

1. Obtain an aged listing of accounts receivable. For a sample of individual customers on the listing, agree the customer's name, amount, and other information with the corresponding information in the accounts receivable master file.

(1) ________.

(2) ________.

2. Examine details of sales for five days before and five days after year-end to determine whether sales have been recorded in the proper period.

(1) ________.

(2) ________.

3. Assess the reasonableness of the balance in the allowance for doubtful accounts.

(1) ________.

(2) ________.

4. Inquire as to whether any accounts receivable have been factored or sold during the period.

(1) ________.

(2) ________.

5. Inquire as to whether there are any receivables from related parties.

(1) ________.

(2) ________.

Definitions:

Stored Information

Information that is retained in the brain or another storage system for retrieval and use at a later time.

Sensory Memory

The shortest-term element of memory, it is the ability to retain impressions of sensory information after the original stimuli have ended.

Sensory Modalities

the different channels through which humans and animals perceive the environment, such as sight, sound, touch, taste, and smell.

Stored Information

Information that has been retained in the memory over time.

Q4: The auditor must gather sufficient and appropriate

Q7: Inquiries of clients and reperformance normally have

Q7: Audit risk is the risk there will

Q10: Most auditors believe that financial statements are

Q13: Describe the three categoriof safeguards to an

Q35: The introductory paragraph of the standard audit

Q75: The auditor's best defense when existing material

Q80: Analytical procedures must be used in the

Q93: Companies are required to disclose in their

Q105: Generally, loans between a CPA firm or