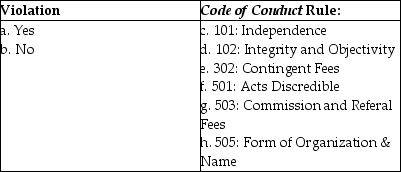

The scenarios below all involve a possible violation of the AICPA's Code of Professional Conduct. For each scenario select:

1. Which rule of the Code the scenario falls under and

2. If the scenario is a violation of the Code for the CPA Firm.

Scenario

1. Margaret Henry is a partner in the Tupelo office of Jenkins & Thorn, CPAs. Margaret's father is the controller at Markrich Sporting Supplies, Inc., a publicly held company in Tupelo. Markrich is one of Jenkins & Thorn's audit clients. Margaret is not involved in the audit of Markrich.

2. Jason Alexander is an audit manager with Reese & Co., CPAs. Jason owns 100 shares of common stock in one of the firm's audit clients, but he does not provide any audit or non-audit services to the company.

3. The accounting firm of Fine & Herman, CPAs, provides bookkeeping and tax services for Henderson Corporation, a privately held company. Mr. Herman also performs the annual audit of Henderson Corporation.

4. Elaine Cooper CPA, is the auditor of Paula's Pizza. Towards the end of the audit, Paula gave Elaine her estimate of receivable collectability and Elaine accepted it without further cooperation.

5. Charley Ray, CPA, is a member of the engagement team that performs the audit of Desiree Corporation. Charley's five-year-old daughter, Becky, received ten shares of Desiree common stock for her fifth birthday in a trust fund established by Becky's grandmother.

6. Freeman and Johnson formed a successful CPA practice ten years ago. In 20x4, they approached Adam Sawtooth, a surgeon and medical expert, and asked him to assist them with their growing medical consulting practice. Sawtooth agreed, but only after he was given an ownership interest in the firm. Sawtooth does intend to reduce his private practice hours and spend 40% of his working hours devoted to the Freeman & Johnson practice.

7. Salley Preen has a successful computer network consulting business. Sally has recommended one of her clients to Sam Walton, CPA. To show gratitude for the referral, Sam has agreed to pay Sally a token gift of $50. Sam has not disclosed the payment arrangement to his new clients.

8. The accounting firm of Swift & Taylor, CPAs, is negotiating a fee with a new audit client where the client will pay $50,000 if the client obtains the line of credit needed for working capital purposes otherwise, the fee will be $40,000.

9. Brad Long, CPA, was traveling from Orlando to Miami, Florida when he was pulled over by a police officer on suspicion of driving under the influence. He was convicted in court of driving while under the influence of alcohol and received six months probation.

10. Sammy Bryant, CPA, is a senior in a one-office CPA firm that audits Childress, Inc., a closely held corporation. Sammy's sister was recently appointed as the assistant controller for Childress, Inc.

Definitions:

Skewed

A term describing a distribution that is not symmetrical, where one of its tails is longer than the other, indicating a deviation from the normal distribution.

Histogram

A graphical representation of data distribution where data is grouped into ranges and each range's frequency is represented by the height of a bar.

Skewed

Refers to a distribution that is not symmetrical, where one tail is longer or fatter than the other.

Pregnant Women

Females in the state of carrying a developing fetus within their womb.

Q4: The form that must be filed with

Q9: The auditor's evaluation of the likelihood of

Q19: Which of the following is not an

Q20: The auditor's first course of action when

Q27: The overall purpose of the Securities and

Q31: Integrity is one of the IIA's ethical

Q61: Discuss three audit procedures commonly used to

Q62: A pervasive exception is one that affects

Q66: The following situations involve a possible violation

Q109: A CPA firm normally uses one or