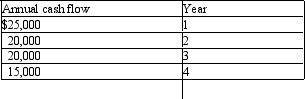

Palmetto Products is considering the purchase of a new industrial machine. The estimated cost of the machine is $50,000. The machine is expected to generate annual cash inflows for the next four years as follows:  The machine is not expected to have a residual value at the end of its useful life. If Palmetto uses a discount rate of 16%, what is the expected net present value of the machine? (ignore taxes)

The machine is not expected to have a residual value at the end of its useful life. If Palmetto uses a discount rate of 16%, what is the expected net present value of the machine? (ignore taxes)

Definitions:

Net Present Value (NPV)

The discrepancy between cash inflows' present value and cash outflows' present value during a defined timeframe.

Scenario Approach

A strategic planning method that explores future possibilities by simulating different plausible future outcomes.

Simulation Analysis

A method of assessing the impact of different variables on a project or investment by running multiple scenarios.

CCA Rate

Stands for Capital Cost Allowance rate, which is the rate at which a business can depreciate its assets for tax purposes in certain jurisdictions.

Q4: Behaviors such as rolling over, sitting up,

Q6: Joyner Products Joyner Products makes cedar garden

Q21: Discuss how the shift from labor intensive

Q23: Why is sociological jurisprudence seen to resemble

Q23: Blue Ridge Resorts has the following pretax

Q25: Which of the following would be a

Q28: Which of the following will always be

Q35: Which of the following independent checks blocks

Q48: Holmes Manufacturing Inc. had the following purchases

Q102: Camden Products Inc. manufacturers travel accessories. The