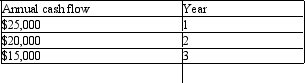

Mac Products Inc. is considering the purchase of a new machine. The estimated cost of the machine is $30,000. The machine is expected to generate annual cash inflows over the next three years as follows:  The machine will be depreciated with no half-year convention over its three-year life using the straight-line method and is not expected to have a residual value at the end of its useful life. The company considers income tax effects in all of its capital investment decisions. If the company's income tax rate is 35% and they desire an after-tax return of 14% on investments, the net present value of the new machine is:

The machine will be depreciated with no half-year convention over its three-year life using the straight-line method and is not expected to have a residual value at the end of its useful life. The company considers income tax effects in all of its capital investment decisions. If the company's income tax rate is 35% and they desire an after-tax return of 14% on investments, the net present value of the new machine is:

Definitions:

Credit Column

The column in an accounting ledger where credit transactions are recorded, reflecting increases in liabilities, equity, or revenue, or decreases in assets or expenses.

Service Revenue

The income a company earns from providing services as opposed to selling physical goods, and it is recorded as it is earned in the accounting period.

Balance Sheet Columns

Sections in a balance sheet that categorize assets, liabilities, and shareholder's equity at a specific point in time.

Unearned Revenue

Money received by a company for goods or services not yet delivered or provided; often considered a liability.

Q2: Quinton Products manufactures digital cameras. Currently, the

Q2: Global mental functions are those general mental

Q4: A local skating rink charges each person

Q4: Cultural variations in motor development mean:<br>A) Assessments

Q5: Parents may have problems supporting attachment with

Q9: Quality of life is a term that

Q17: Assuming a company's income statement shows a

Q38: Though formal natural law defense is not

Q48: Holmes Manufacturing Inc. had the following purchases

Q69: Compton Corporation The following overhead cost information