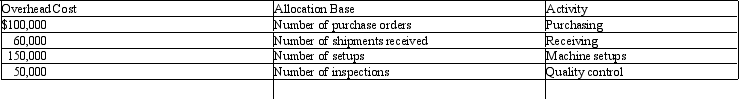

Compton Corporation The following overhead cost information is available for Compton Corporation for 2011: During the year, 5,000 purchase orders were issued; 20,000 shipments were received; 3,000 machine setups were performed; and 4,000 inspections were conducted.

During the year, 5,000 purchase orders were issued; 20,000 shipments were received; 3,000 machine setups were performed; and 4,000 inspections were conducted.

Refer to the Compton Corporation information above. If Job #229 required 5 purchase orders, 10 shipments, 8 machine setups, and 4 inspections to fill, how much overhead should be assigned to Job #229?

Definitions:

Tax Rate

The proportion of income that the government taxes an individual or company.

Tax Bill

A statement from a governmental authority detailing the amount of taxes owed by an individual or entity, specifying due dates and payment instructions.

Proration

The act of distributing or assigning an amount in proportion to a certain measure, often applied in finance and accounting for dividing expenses or revenues.

Taxable Year

A 12-month period for which tax returns are calculated and filed, often aligning with the calendar year or a company’s fiscal year.

Q3: Grogan Inc. Grogan Inc. had the following

Q8: ABC Manufacturing sells widgets for $6.00 each.

Q14: Hudson Inc. Hudson Inc. has the following

Q15: How is the current ratio calculated, and

Q28: The difference between sales and cost of

Q46: Hardister Corp. Hardister Corp. has the following

Q51: NC Products Inc. is considering investing in

Q72: Cash received by borrowing from line of

Q76: Which of the following statements is true

Q92: What is the difference between a screening