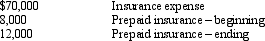

MTM Inc. had the following information available from its 2011 balance sheet and income statement:

Required: Compute the amount that would be reported as "cash paid for insurance" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash paid for insurance" on the statement of cash flows using the direct method.

Definitions:

Effective Tax Rate

The average percentage of net income that a person or corporation pays in taxes, effectively showing the portion of income gone to taxes.

Non-Controlling Interest

A minority share of ownership in a subsidiary that is not directly controlled by the parent company, typically reflected in the equity section of the consolidated financial statement.

Consolidated Financial Position

A representation of a parent company and its subsidiaries' financial status as one entity, summarizing assets, liabilities, and equity.

Acquisition Differential

The difference between the purchase price of a company and the fair value of its identifiable net assets at the acquisition date.

Q2: Which of the following types of companies

Q6: Latimer Textiles Inc. Latimer Textiles Inc. incurred

Q7: McClintock Inc. had the following information available

Q28: Which of the following statements accurately describes

Q41: Peter Piper Inc. had the following information

Q82: Partin Manufacturing Partin Manufacturing has the following

Q90: Miller Company has an unfavorable materials price

Q99: Cornell Products has the following information available

Q102: What are two disadvantages of decentralization?

Q156: Return on investment (ROI) is a measure