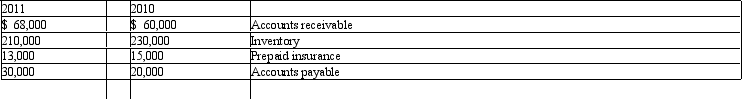

Gregson Company had the following noncash current asset and current liabilities balances at the end of 2010 and 2011:  Net income for 2011 was $750,000 and depreciation expense was $40,000. All sales and all purchases are on account. Gregson uses the indirect method for preparing the statement of cash flows.

Net income for 2011 was $750,000 and depreciation expense was $40,000. All sales and all purchases are on account. Gregson uses the indirect method for preparing the statement of cash flows.

Net cash flows from operating activities for 2011 would be:

Definitions:

Discounted Payback

A method in capital budgeting that determines the amount of time needed to recover the initial investment, accounting for the present value.

Payback Method

An approach within capital budgeting that determines how long it takes to regain the initial outlay for an investment.

Mutually Exclusive

This term describes options or decisions that cannot occur simultaneously; choosing one means forgoing the others.

Required Rate

The minimum percentage return that an investment must yield to be considered acceptable. It is essentially another term for the required return on investment, critical for financial planning and analysis.

Q11: Cash received from the sale of property

Q13: Which of the following statements is false

Q23: Aronson & Associates LLP Aronson & Associates

Q25: Which of the following statements is true

Q26: You run a regression analysis and receive

Q32: Troxler Inc. produces various types of floor

Q68: Pomander Inc. had the following information related

Q77: The following overhead cost information is available

Q78: Hayward Inc. Hayward Inc. produces a unique

Q79: Which of the following types of employees