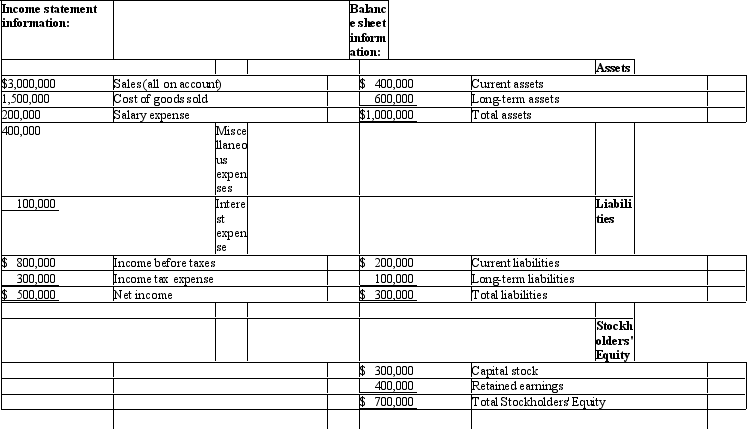

Hardister Corp. Hardister Corp. has the following information available from its financial statements for 2012: Refer to the Hardister Corp. information above. At the end of 2012, Hardister's common stock was listed on the stock exchange as having a market price of $65 per share and there are 10,000 shares outstanding. Hardister has no preferred stock. What would be Hardister's price earnings (P/E) ratio for 2012? (round to two decimal places)

Refer to the Hardister Corp. information above. At the end of 2012, Hardister's common stock was listed on the stock exchange as having a market price of $65 per share and there are 10,000 shares outstanding. Hardister has no preferred stock. What would be Hardister's price earnings (P/E) ratio for 2012? (round to two decimal places)

Definitions:

Total Surplus

The sum of consumer surplus and producer surplus, representing the total net benefit to society from producing and consuming a good or service.

Consumer Surplus

Consumer surplus is the difference between the total amount that consumers are willing and able to pay for a good or service and the total amount they actually pay.

Producer Surplus

The gap between the price producers are ready to take for offering a product or service and the actual payment they receive.

Consumer Surplus

The difference between what consumers are willing to pay for a good or service and what they actually pay, representing the benefit consumers receive.

Q8: Wintergreen Products allocates overhead based on direct

Q10: If a company consistently produces and sells

Q14: Hudson Inc. Hudson Inc. has the following

Q48: A unified credit is subtracted in calculating

Q53: All else being equal, which of the

Q65: Christian transferred $60,000 to an irrevocable trust

Q74: Which types of quality costs are incurred

Q82: Partin Manufacturing Partin Manufacturing has the following

Q86: The gift-splitting election only applies to gifts

Q102: What are two disadvantages of decentralization?