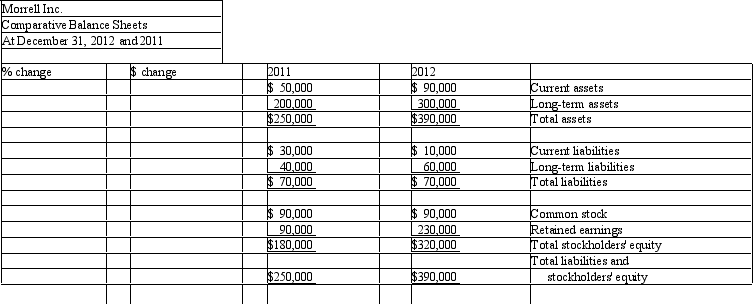

Morrell Inc. had the following information available from its 2011 and 2012 condensed balance sheets

Required: Using horizontal analysis, complete the comparative income statement by computing dollar change ($change) and percentage change (% change). Round percentages to two decimal places.

Required: Using horizontal analysis, complete the comparative income statement by computing dollar change ($change) and percentage change (% change). Round percentages to two decimal places.

Definitions:

Cost of Capital

The rate of return that a company must earn on its projects to maintain its market value and attract investment.

M&M Proposition I

A theory in corporate finance that states the value of a firm is unaffected by how it is financed, in the absence of taxes, bankruptcy costs, and asymmetric information.

M&M Proposition II

A theory in corporate finance stating that a firm's cost of equity increases with its level of debt, considering there are no taxes, transaction costs, or bankruptcy costs.

Q2: Grogan Inc. Grogan Inc. had the following

Q3: Which of the following statements is true

Q6: Johnson Manufacturing Johnson Manufacturing anticipates incurring $850,000

Q9: Give two examples for each of the

Q26: Johnson Manufacturing has the following selected information

Q27: Which of the following statements comparing traditional

Q57: Meow Products Ltd. Meow Products Ltd. produces

Q79: Allocation:<br>A) is most often used for direct

Q90: The foreign tax credit regime is the

Q94: Aronson & Associates LLP Aronson & Associates