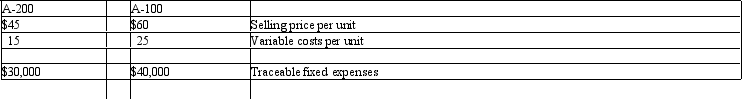

Amber Products Inc. has two product lines: A-100 and A-200. Revenue and cost information for each of the product lines for 2011 are as follows:

In 2011, Amber had common fixed expenses of $50,000, and the company produced and sold 4,000 units of A-100 and 6,000 units of A-200.

In 2011, Amber had common fixed expenses of $50,000, and the company produced and sold 4,000 units of A-100 and 6,000 units of A-200.

Required: Prepare a segmented income statement with a column for each product line and the total company.

Definitions:

Social Security Act

A law enacted to provide for the general welfare by establishing a system of federal old-age benefits, and by enabling states to make more adequate provision for aged persons, blind persons, dependent and crippled children, maternal and child welfare, public health, and the administration of their unemployment compensation laws.

Employee Retirement Income Security Act

A federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

Family and Medical Leave Act

A U.S. law that provides employees with up to 12 weeks of unpaid, job-protected leave per year for certain family and medical reasons.

Consolidated Omnibus Budget Reconciliation Act

A federal law in the United States that provides individuals and their families the right to continue health care coverage under the group plan for limited periods under certain conditions.

Q3: Which of the following statements is true

Q5: The Federal transfer taxes are calculated using

Q13: Reliable Manufacturers had no units in process

Q20: Which of the following persons should not

Q41: Greenlaw Products uses job order costing and

Q49: Subpart F income earned by a CFC

Q71: JAX Inc. In early 2012, JAX Inc.

Q89: Chilé Products Ltd. Chilé Products Ltd. bottles

Q116: HNW Ltd. HNW Ltd. manufactures and sells

Q132: Which of the following is a requirement