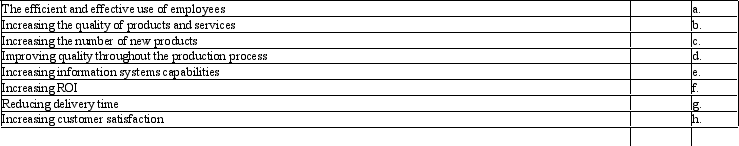

Match the following critical success factors with the appropriate perspective of the balanced scorecard. Use the following key: F = Financial, C = Customer, IB = Internal business, and LG = Learning and growth.

Definitions:

Taxable Income

The amount of an individual's or corporation's income used to determine how much tax is owed, calculated as gross income minus deductions and exemptions.

Energy-Efficient Furnace

A heating system designed to use less energy for the same level of heating comfort compared to less efficient models.

Exemption

Information included on tax forms that lowers taxes; exemptions include dependents as well as the taxpayer.

Taxable Income

The portion of income used to calculate how much tax an individual or a corporation owes to the government, after all deductions and exemptions.

Q13: Which of the following statements is true

Q22: For each of the following activities, indicate

Q26: Vance Inc. had the following condensed income

Q31: Chloe's gross estate consists of the following

Q36: The following account balances are for the

Q38: How are profitability ratios used by different

Q39: Which of the following statements about the

Q46: A rectangle with a triangle within it

Q58: Under ideal conditions, companies operating in a

Q129: For an S corporation shareholder to deduct