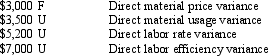

At the end of the year, your company had the following variances:

Give at least one possible cause for each of the variances and discuss the possible relationships between them.

Give at least one possible cause for each of the variances and discuss the possible relationships between them.

Definitions:

Federal Income Tax

A yearly fee assessed by the national government on the income of individuals, corporations, trusts, and assorted legal entities.

Gross Earnings

The total income earned by an individual or business before any deductions like taxes or benefits.

FUTA

Federal Unemployment Tax Act; a United States federal law that imposes a payroll tax on businesses to fund state workforce agencies.

SUTA

State Unemployment Tax Act, a U.S. federal law that imposes a payroll tax on employers to fund the unemployment compensation program.

Q8: Which of the following is a true

Q23: Return on investment (ROI) is calculated by:<br>A)

Q41: Which of the following tax or non-tax

Q56: Cash received from the sale of long-term

Q57: Meow Products Ltd. Meow Products Ltd. produces

Q69: Which of the following statements regarding a

Q73: On a common-size income statement, operating expenses

Q76: Santa Fe Corporation manufactured inventory in the

Q87: As a manager, how would you determine

Q88: The PW partnership's balance sheet includes the