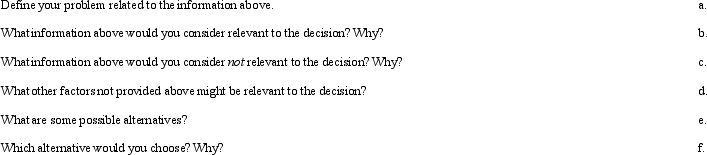

A friend has informed you of a part-time job for which you are well-qualified. It would begin next semester and require working 20 hours a week at a rate of $35 per hour. You would have to commute 2 hours round trip four days a week to work. You have already registered for 18 credit hours (6 classes) next semester, and you have been told that each of the classes is very demanding, requiring projects and extensive study time. If you complete these 18 hours, you will graduate. You are only taking 12 credit hours this semester. You have enough money for tuition ($100 per credit hour) and room and board but would love some extra spending money.

Required:

Definitions:

Variable Selling

Costs associated with selling a product that vary with the level of sales activity, such as commissions or shipping fees.

Administrative Expenses

These are the expenses that an organization incurs not directly tied to a specific function such as manufacturing, production, or sales.

Variable Costing

An approach to costing that accounts for just the variable costs of production, including direct materials, direct labor, and variable manufacturing overhead, in the calculation of product costs.

Product Unit Cost

The total cost associated with producing a single unit of a product, encompassing both direct materials and direct labor costs.

Q14: Which of the following will least likely

Q25: Grant Enterprises is considering the introduction of

Q47: Separately stated items are tax items that

Q51: The annual exclusion eliminates relatively small transfers

Q84: Which of the following items is not

Q103: ABC was formed as a calendar-year S

Q109: WSR Inc. WSR Inc. sells a variety

Q112: The IRS may consent to an early

Q113: The unified credit is designed to:<br>A)apply only

Q151: Describe the customer perspective of the balanced