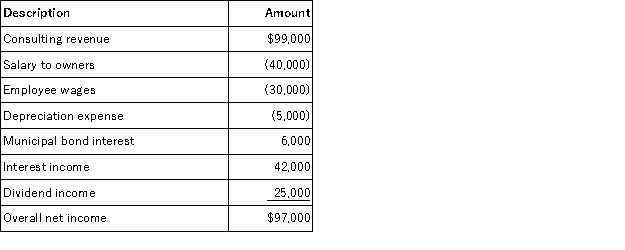

RGD Corporation was a C corporation from its inception in 2011 through 2015. However, it elected S corporation status effective January 1, 2016. RGD had $50,000 of earnings and profits at the end of 2015. RGD reported the following information for its 2016 tax year.

What amount of excess net passive income tax is RGD liable for in 2016? (Round your answer for excess net passive income to the nearest thousand)

Definitions:

Insanity

A legal term for a mental disorder so severe that it prevents a person from understanding the difference between right and wrong or from being able to control their actions.

Systematic Desensitization

A behavioral therapy technique used to help individuals overcome phobias and anxieties by gradually exposing them to the feared object or context without any danger.

Phobia

An intense, irrational fear of a specific object, situation, or activity that leads to significant anxiety and avoidance behaviors.

Free Association

A psychoanalytic therapy technique where patients verbalize all thoughts that come to mind without censorship, used to explore the unconscious mind.

Q41: Which of the following tax or non-tax

Q48: Latimer Textiles Inc. Latimer Textiles Inc. incurred

Q48: Clampett, Inc. has been an S corporation

Q53: Which of the following statements best describes

Q55: Longhorn Company reports current E&P of $100,000

Q62: Which of the following individuals is not

Q83: Parker is a 100% shareholder of Johnson

Q91: The partnership making an operating distribution will

Q96: Davison Company determined that the book basis

Q128: Suppose at the beginning of 2016, Jamaal's