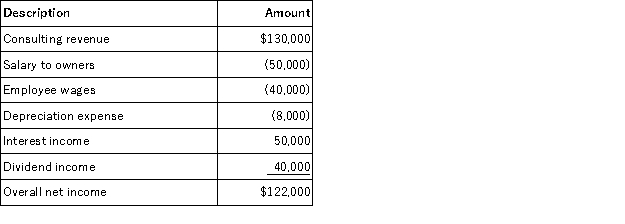

RGD Corporation was a C corporation from its inception in 2012 through 2015. However, it elected S corporation status effective January 1, 2016. RGD had $50,000 of earnings and profits at the end of 2015. RGD reported the following information for its 2016 tax year.

What amount of excess net passive income tax is RGD liable for in 2016? (Round your answer for excess net passive income to the nearest thousand)

Definitions:

Yield Curve

A line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates.

Normal Yield Curve

A graphical representation that shows interest rates on bonds of different maturities tend to increase the longer the term to maturity, under normal market conditions.

Expected Inflation

The anticipated rate at which the general level of prices for goods and services will rise over a period.

Expectations Theory

A theory that explains the term structure of interest rates based on the anticipation that the rates will move toward the average rate over the long term.

Q7: Ashley transfers property with a tax basis

Q30: Which of the following income items from

Q33: Shea is a 100% owner of Mets

Q34: Which of the following statements best describes

Q38: A couple who is married at the

Q62: Which of the following individuals is not

Q64: This year, Brent by himself purchased season

Q66: The built-in gains tax does not apply

Q81: When the quantity of materials purchased and

Q109: An S corporation shareholder calculates his initial