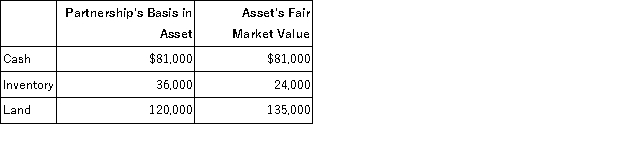

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Slaveholders

Individuals or entities that owned slaves, typically in historical contexts where slavery was legally practiced.

Slaves

Individuals who are legally owned by others and forced to work without the right to freedom or compensation.

Religion

A set of spiritual beliefs, practices, and values that individuals or communities follow, often centered around a deity or moral philosophy.

Blacks

Refers to people of Sub-Saharan African descent, often used within the context of discussing racial demographics, culture, or issues of racial inequality.

Q18: Compensation recharacterized by the IRS as a

Q29: Which of the following entities is not

Q45: Including adjusted taxable gifts in the taxable

Q53: The definition of property as it relates

Q56: The gift tax is imposed on intervivos

Q67: Tammy owns 100 shares in Star Struck

Q69: Which of the following statements best describes

Q71: Assume Joe Harry sells his 25% interest

Q93: Under most U.S. treaties, a resident of

Q118: Which of the following S corporations would