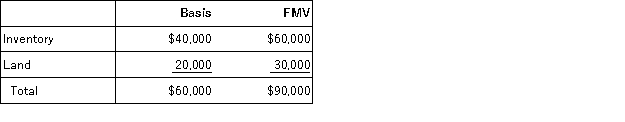

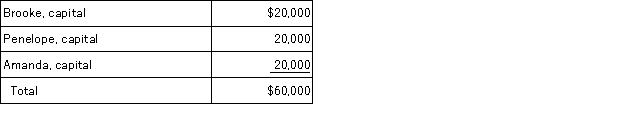

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

X Chromosome

One of the two sex chromosomes, X and Y, that determine genetic sex. The X chromosome carries a significant number of genes responsible for various bodily functions.

Physical Contact

Interaction involving touch between individuals, which can influence emotional well-being and social bonding.

Autism

A developmental disorder characterized by challenges in social interaction, communication, and by restricted and repetitive behaviors.

Biological Treatments

Approaches to treating psychological disorders that involve interventions into the biological body, such as medication, surgery, or diet changes to influence brain and body functions.

Q2: SEC Corporation has been operating as a

Q31: Rainier Corporation, a U.S. corporation, manufactures and

Q33: Jasmine transferred 100 percent of her stock

Q45: Which manager activity would address the decision

Q50: Assume Joe Harry sells his 25% interest

Q60: Irish Corporation reported pretax book income of

Q75: Kim received a 1/3 profits and capital

Q82: Which of the following statements is(are) true

Q85: A corporation with an AMTI of $400,000

Q119: A future interest is a right to