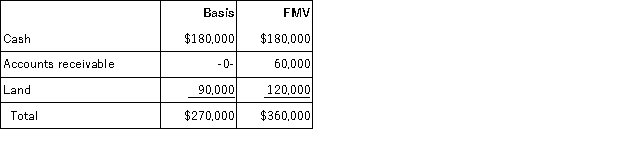

The SSC Partnership balance sheet includes the following assets on December 31 of the current year:

Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

Definitions:

Clauses Separation

The practice of distinctly dividing sections of a sentence, contract, or legal document with punctuation or formatting to enhance readability and understanding.

Direct Approach

A method of communication where the main point or message is presented straight away at the beginning.

Attributing Blame

The act of assigning responsibility for a mistake, fault, or wrong to a person or entity.

You Attitude

A communication approach that focuses on the reader or listener, emphasizing their interests and feelings, often used to enhance the effectiveness of business communication.

Q2: A corporation evaluates the need for a

Q13: Large corporations are allowed to use the

Q14: Heron Corporation reported pretax book income of

Q19: Evergreen Corporation distributes land with a fair

Q49: An S corporation can use a non-calendar

Q80: For a corporation, goodwill created in an

Q81: S corporations are not entitled to a

Q88: Adjusted taxable gifts are added to the

Q88: Which of the following statements regarding the

Q89: Ozark Corporation reported taxable income of $500,000