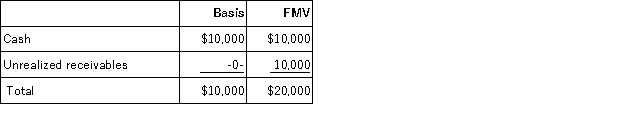

The PW partnership's balance sheet includes the following assets immediately before it liquidates:

In complete liquidation PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners) . Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?

Definitions:

Substitution Effect

The change in consumption patterns due to a price change that makes one good more economically attractive than its alternatives.

Output Effect

Output Effect is the impact on total production or output when a firm adjusts its resources, such as labor or capital, in response to changes in market conditions.

Substitute Resource

A resource or product that can be used in place of another to fulfill a similar function or need.

Marginal Revenue Product Curve

A graphical representation showing how the revenue generated from selling an additional unit of a good or service changes as more units are produced.

Q4: Barry has a basis in his partnership

Q5: Au Sable Corporation reported taxable income of

Q11: No deductions are allowed when calculating the

Q27: Purple Rose Corporation reported pretax book income

Q38: The focus of ASC 740 is the

Q40: Temporary differences create either a deferred tax

Q42: Nadine Fimple is a one-third partner in

Q59: Over what time period do corporations amortize

Q66: Which of the following statements concerning the

Q71: A company's effective tax rate can best