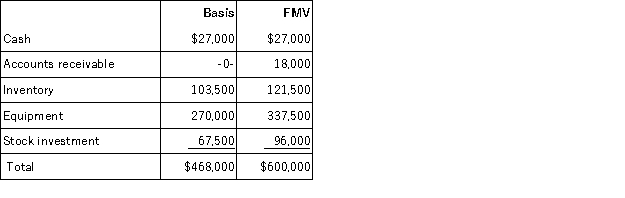

Victor is a 1/3 partner in the VRX partnership with an outside basis of $156,000 on January 1. Victor sells his partnership interest to Raj on January 1st for $200,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased 7 years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

False Negative

An error in test results in which a positive condition is incorrectly reported as negative.

Discrete Probability Distribution

A statistical distribution that shows the probabilities of outcomes with distinct values.

Standard Deviation

A metric that quantifies the spread or variation of a data collection in comparison to its average value.

Probability Distribution

Describes how probabilities are distributed over the values of a random variable; it's a mathematical function showing the likelihood of different outcomes.

Q12: All taxes paid to a foreign government

Q12: Which of the following class of stock

Q29: The generation-skipping tax is designed to accomplish

Q37: Superior Corporation reported taxable income of $1,000,000

Q45: The rules for consolidated reporting for financial

Q46: You and your roommate would like to

Q46: S corporations are treated in part like

Q65: A shareholder will own the same percentage

Q80: For a corporation, goodwill created in an

Q96: The unified credit is designed to allow