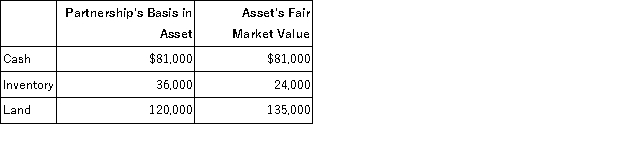

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Sensitization

The process of becoming more sensitive to a particular stimulus over time, often as a result of repeated exposure.

Readiness

A state of being fully prepared or in a suitable condition for an immediate action or use.

Fixed Action Pattern

An instinctive behavioral sequence that is relatively invariant within the species and almost inevitably runs to completion once initiated.

Dishabituation

The renewal of a response, previously habituated, following a change in stimulus.

Q2: Mandel transferred property to his new corporation

Q6: A corporation may carry a net capital

Q22: General Inertia Corporation made a pro rata

Q25: The tax rate for the corporate alternative

Q51: Which statement best describes the U.S. framework

Q53: Sherburne Corporation reported current earnings and profits

Q77: A bypass provision in a will requires

Q97: Aztec Company reports current E&P of $200,000

Q99: Tyson is a 25% partner in the

Q114: At his death Titus had a gross