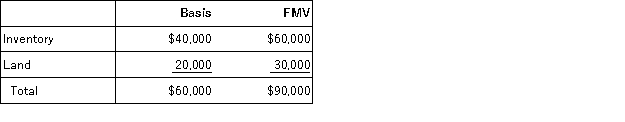

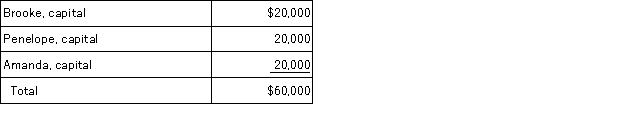

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Probability

An assessment of the probability that a certain event will happen.

Function

A relationship or rule that defines how one variable's values are determined by another variable or other variables.

Standard Deviation

A statistic that measures the dispersion or variation of a dataset relative to its mean, indicating how spread out the data points are.

Exam Grades

A set of scores assigned to students to evaluate their performance on academic tests or assessments.

Q1: Knollcrest Corporation has a cumulative book loss

Q18: As part of its uncertain tax position

Q20: A gratuitous transfer of cash to an

Q36: Green Corporation has current earnings and profits

Q38: Which of the following statements best describes

Q40: Temporary differences create either a deferred tax

Q41: An unfavorable temporary book-tax difference is so

Q42: A partnership may use the cash method

Q97: In what order should the tests to

Q133: Clampett, Inc. has been an S corporation