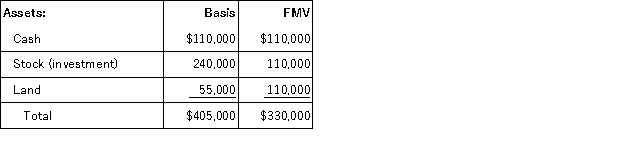

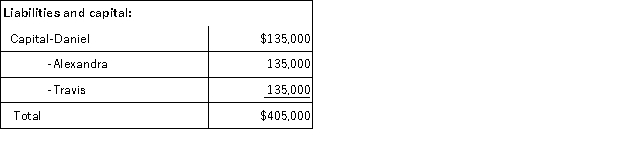

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Span of Control

The number of subordinates a manager or supervisor can effectively manage and control.

Administrative Costs

Expenses associated with daily operations of managing a business or organization, including office supplies, salaries of non-production staff, and utilities.

Customer Classification Departments

Divisions within a company that segment customers based on various criteria to tailor marketing and service delivery.

Mercy Medical Center

A healthcare institution providing medical care and services; without specific details, this can refer to any one of several hospitals by the same name in different locations.

Q2: Joan is a 1/3 partner in the

Q31: Large corporations (corporations with over $1,000,000 in

Q50: Packard Corporation reported pretax book income of

Q57: Crystal, Inc. is owned equally by John

Q57: The gross profit from a sale of

Q71: This year Don and his son purchased

Q74: Sunapee Corporation reported taxable income of $700,000

Q79: Obispo, Inc., a U.S. corporation, received the

Q93: Tax elections are rarely made at the

Q99: Cecilia, a Brazilian citizen and resident, spent