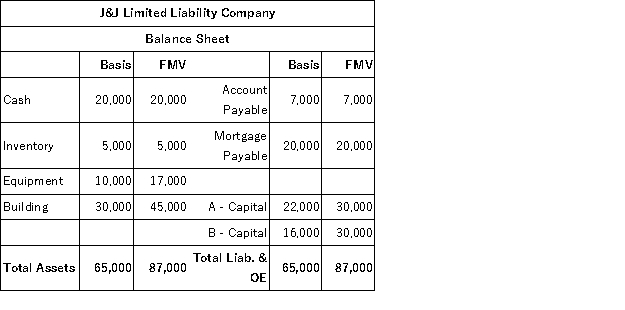

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and

C.The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interest in J&J.Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capital interest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Cost of Sales

Direct costs attributable to the production of the goods sold by a company, including material and labor costs.

Inventories

The complete list of items such as property, goods in stock, or the contents of a building.

Accounts Payable

The amounts due by a company to its suppliers or creditors for goods and services received but not yet paid for.

Net Cash Inflow

The difference between the cash received and cash expended in a given period, resulting in an increase in cash holdings.

Q12: Weaver Company had a net deferred tax

Q33: Shea is a 100% owner of Mets

Q46: A rectangle with a triangle within it

Q66: The built-in gains tax does not apply

Q75: Which of the following statements regarding net

Q86: Antoine transfers property with a tax basis

Q93: Both Schedules M-1 and M-3 require taxpayers

Q100: Which of the following statements best describes

Q104: On January 1, 2005 [before the adoption

Q105: Andrea transferred $500,000 of stock to a