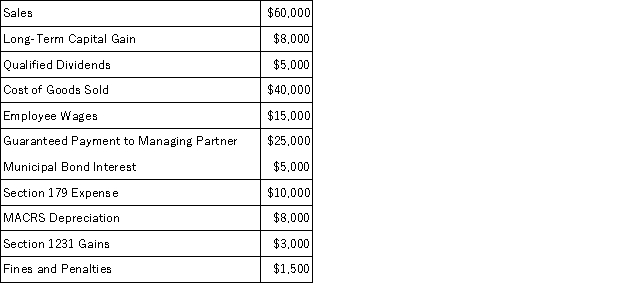

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Definitions:

Distribution Centre

A specialized facility that is responsible for receiving, storing, and distributing products to retailers or customers.

Labour Cost

The expense associated with the work performed by employees, encompassing salaries, wages, and additional benefits.

Productivity

The ratio of outputs (goods and services) divided by one or more inputs (such as labour, capital, or management).

Labour Cost Per Unit

The total expense of labor required to produce a single unit of output, encompassing wages, benefits, and any other compensation.

Q4: S corporation allocated losses to a shareholder

Q5: Shauna is a 50% partner in the

Q11: After terminating or voluntarily revoking S corporation

Q42: Sweetwater Corporation declared a stock dividend to

Q51: Camille transfers property with a tax basis

Q55: On which tax form does a single

Q85: Distributions to owners may not cause the

Q85: Gull Corporation reported pretax book income of

Q87: Sybil transfers property with a tax basis

Q92: Mike and Michelle decided to liquidate their