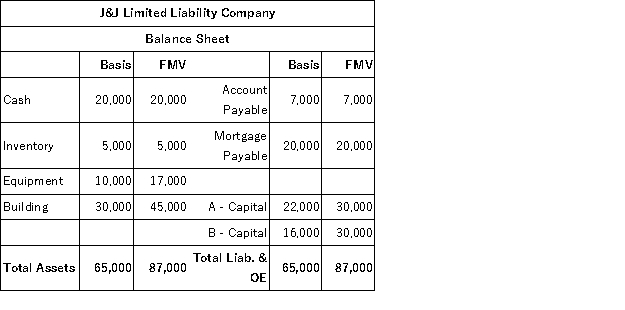

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and

C.The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interest in J&J.Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capital interest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Price Discrimination

A pricing strategy where a seller charges different prices for the same product or service to different customers, not based on cost differences but on consumers' willingness to pay.

Preference in Pricing

A practice where certain customers are offered better prices or terms than others, often based on the volume of business, loyalty, or strategic importance.

Clayton Act

A U.S. antitrust law aimed at promoting competition among businesses by prohibiting certain practices that restrict commerce.

Tying Contracts

Agreements where the sale of one product (the tying product) is conditioned on the purchase of another (the tied product).

Q15: A stock-for-stock Type B reorganization will be

Q22: The estimated tax rules for S corporations

Q34: This year Nathan transferred $2 million to

Q36: Last year Brandon opened a savings account

Q37: For the holidays, Samuel gave a necklace

Q57: Clampett, Inc. converted to an S corporation

Q61: Heidi and Teresa are equal partners in

Q67: John, a limited partner of Candy Apple,

Q92: A partner's outside basis must first be

Q101: This year Carlos and Hailey purchased realty