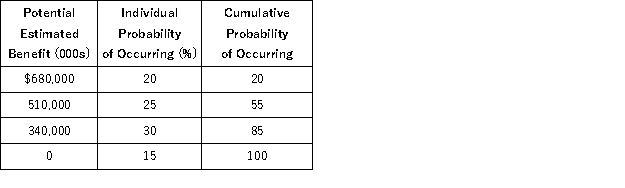

Morgan Corporation determined that $2,000,000 of its domestic production activities deduction on its current year tax return was uncertain, but that it was more likely than not to be sustained on audit. Management made the following assessment of the company's potential tax benefit from the deduction and its probability of occurring.

Under ASC 740, what amount of the tax benefit related to the domestic production activities deduction can Morgan recognize in calculating its income tax provision in the current year?

Definitions:

Discount Rate

The interest rate used to discount future cash flows of a financial instrument; a measure of the time value of money.

Discount Rate

The interest rate used in discounted cash flow analysis to determine the present value of future cash flows, reflecting the opportunity cost of capital.

Present Value

Today's value of a future monetary sum or cash flow sequence, determined using a predefined rate of return.

Future Cash Flows

The projected cash earnings or revenues a company expects to receive from its operations or investments in the future.

Q26: Which of the following refers to the

Q29: Which of the following entities is not

Q43: Type A reorganizations involve the transfer of

Q48: Unincorporated entities with only one individual owner

Q76: Which of the following statements is true

Q78: On April 1, year 1, Mary borrowed

Q97: Brady owns a second home that he

Q109: Coop Inc. owns 40% of Chicken Inc.,

Q126: It is important to distinguish between temporary

Q134: For incentive stock options granted when ASC