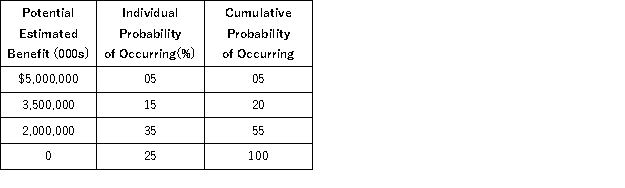

Acai Corporation determined that $5,000,000 of its R&D credit on its current year tax return was uncertain. Acai determined that there was a 40 percent chance of the credit being sustained on audit. Management made the following assessment of the company's potential tax benefit from the R&D credit and its probability of occurring.

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Definitions:

Q8: Tyson, a one-quarter partner in the TF

Q14: Heron Corporation reported pretax book income of

Q42: AB Inc. received a dividend from CD

Q44: Dean has earned $70,000 annually for the

Q47: Simone transferred 100 percent of her stock

Q55: Taxpayers who use a vacation home for

Q56: Which of the following best describes a

Q77: Which of the following best describes distributions

Q93: Sara owns 60 percent of the stock

Q106: Calendar-year corporations that request an extension for