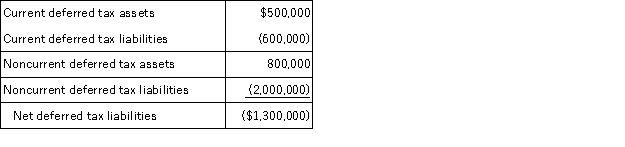

In 2016, Moody Corporation recorded the following deferred tax assets and liabilities:

All of the deferred tax accounts relate to temporary differences that result from the company's U.S. operations. Moody wants to minimize the number of deferred tax accounts it reports on the balance sheet. What is the minimum number of deferred tax accounts Moody can report on its balance sheet and what are the names and dollar amounts in each account, assuming Moody early adopts ASU 2015-17?

Definitions:

Financial Gain

The increase in equity or wealth that an individual or company experiences, typically measured in terms of net profit or income.

Fairness

A principle relating to justice, equity, and impartiality within the allocation of resources or treatment of individuals.

Endowment Effect

The phenomenon in which people ascribe more value to things merely because they own them.

Loss Aversion

A concept in behavioral economics stating that individuals prefer avoiding losses to acquiring equivalent gains, showing that losses have a greater emotional impact than gains.

Q19: Izzo Company reported pretax net income from

Q28: Which of the following is not an

Q33: A corporation may carry a net capital

Q33: Kathy is 60 years of age and

Q39: Cardinal Corporation reported pretax book income of

Q44: Which of the following requirements do not

Q47: On March 15, 20X9, Troy, Peter, and

Q70: Which of the following temporary differences creates

Q73: Frost Corporation reported pretax book income of

Q121: In January 2016, Khors Company issues nonqualified