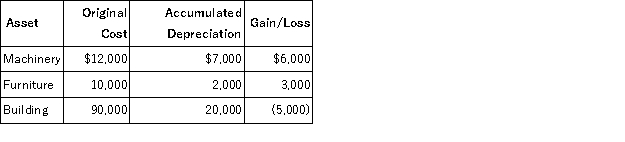

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 30 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Effective Practice

Approaches or methodologies that have consistently shown results superior to those achieved with other means, and are based on evidence.

Policy

A course or principle of action adopted or proposed by an organization or individual.

Rules

Explicit or understood regulations or principles governing conduct within a specific activity or sphere.

Critical Thinking

Critical thinking is the process of actively analyzing, interpreting, evaluating, and synthesizing information in order to form a judgment or conclusion.

Q2: John holds a taxable bond and a

Q8: An office building was purchased on December

Q17: Which one of the following is not

Q26: Which of the following is a true

Q38: Odintz traded machinery for machinery. Odintz originally

Q41: For tax purposes, only unincorporated entities can

Q61: Roy, a resident of Michigan, owns 25

Q63: Tyson had a parcel of undeveloped investment

Q89: Employees who are at least 50 years

Q99: A self-employed taxpayer reports home office expenses