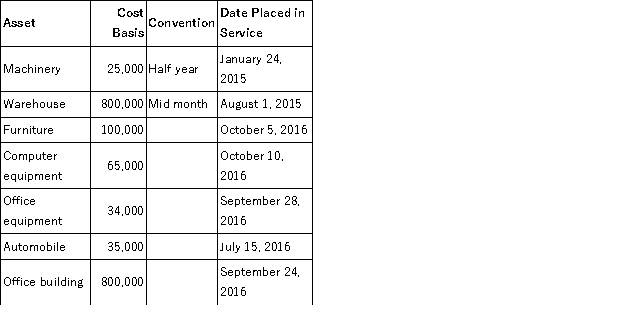

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2015 and 2016:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2015, but would like to elect §179 expense for 2016 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2016, rounded to the nearest whole number (ignore bonus depreciation for 2016). If necessary, use the 2015 luxury automobile limitation amount for 2016 and assume that the 2015 §179 limits are identical to 2016.

Definitions:

Supply Chain

The complete sequence of processes involved in the production and distribution of a commodity, from the raw material supply to the final product delivery to the consumer.

Transportation Systems

The infrastructure and operations involved in transporting goods and people, including roads, railways, airways, and waterways.

Partnering Relationships

Collaborative agreements between two or more organizations to achieve common goals, emphasizing mutual benefits and shared success.

Purchasing Strategy

The planned approach of an organization in acquiring goods and services needed for its operations, which takes into account factors like cost, quality, and supplier relationships.

Q2: John holds a taxable bond and a

Q21: Candace is claimed as a dependent on

Q27: Alexandra purchased a $35,000 automobile during 2016.

Q48: The child and dependent care credit entitles

Q58: Clyde operates a sole proprietorship using the

Q62: What happens if the taxpayer owes an

Q94: Which of the following statements regarding the

Q95: Geithner LLC patented a process it developed

Q102: Which of the following assets are eligible

Q135: Which of the following is not a