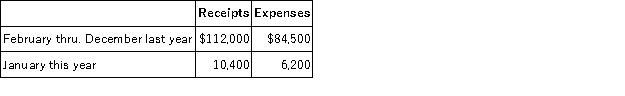

David purchased a deli shop on February 1st of last year and began to operate it as a sole proprietorship. David reports his personal taxes using the cash method over a calendar year, and he wants to use the cash method and fiscal year for his sole proprietorship. He has summarized his receipts and expenses through January 31st of this year as follows:

What income should David report from his sole proprietorship?

Definitions:

Adjusted Trial Balance

A list of all accounts and their balances after adjusting entries are made, used to prepare financial statements.

Closing Entries

Journal entries made at the end of an accounting period to transfer temporary accounts to permanent ones, preparing the company's books for the next period.

Fabricated Products Company

A business that specializes in manufacturing and selling products made from raw materials through various processes.

Income Statements

An income statement is a financial document summarizing a company's revenues, expenses, and profits over a specified period.

Q9: Which of the following is not true

Q20: If an individual taxpayer's marginal tax rate

Q21: Which of the following statements regarding income

Q44: The IRS would most likely apply the

Q51: Bateman Corporation sold an office building that

Q65: Losses associated with personal-use assets, sales to

Q66: Hector is a married self-employed taxpayer, and

Q84: Rhianna and Jay are married filing jointly

Q92: To calculate a gain or loss on

Q93: Kathy is 48 years of age and